Bitcoin(BTC)$115,357.501.15%

Ethereum(ETH)$4,230.272.32%

Tether USDt(USDT)$1.000.02%

BNB(BNB)$1,277.69-1.87%

XRP(XRP)$2.623.22%

Solana(SOL)$205.895.68%

USDC(USDC)$1.000.00%

Dogecoin(DOGE)$0.2143482.93%

TRON(TRX)$0.323149-0.02%

Cardano(ADA)$0.724.40%

ValGet Insights & Updates

Explore the latest updates, trends, and insights about blockchain, crypto investments, and ValGet's journey.

Latest Updates

Smart Contract Audit Completed

ValGet officially passed its smart contract audit by SolidProof, strengthening transparency and investor trust.

On April 7th, 2025, ValGet successfully completed a full smart contract audit conducted by SolidProof, a leading blockchain security provider. This audit confirms that the ValGet protocol is free from critical vulnerabilities and operates securely on the Solana blockchain.

✅ What it means for ValGet:

– Greater investor confidence

– Transparent and secure smart contract logic

– Solid technical foundation before the ICO

– Positive compliance signal for partners and exchanges

Audited projects gain more credibility, attract strategic collaborations, and meet the standards for major exchange listings.

🔗 View the full audit report: https://app.solidproof.io/projects/valget

Solana blockchain, we ensure speed, security, and transparency for all investors. Join us and be part of a new era of tokenized investment!

KYC Process Completed

ValGet has passed KYC verification with SolidProof, reinforcing transparency and project integrity.

On April 7th, 2025, ValGet successfully completed its KYC (Know Your Customer) verification with SolidProof, a leading blockchain audit and compliance provider.

This step confirms that ValGet’s core team is publicly identified and verified, which is crucial for investors, partners, and platforms seeking legitimate and transparent Web3 projects.

✅ Benefits of KYC verification for ValGet:

– Builds community and investor trust

– Minimizes anonymity-related risks

– Supports CEX listing readiness

– Strengthens the project’s credibility and accountability

🔗 SolidProof KYC Certificate: https://app.solidproof.io/board/kyc

🔗 Official Tweet by SolidProof: https://x.com/solidproof_news/status/1911084897906606356

50% of Tokens Locked

ValGet has locked 500 million tokens for 5 years via Streamflow, ensuring long-term stability and investor trust.

To ensure sustainable growth and strengthen investor confidence, ValGet has locked 50% of its total token supply (500 million VALGET) through Streamflow, a trusted decentralized vesting protocol.

The lock-up spans 5 years, with 10% released annually, demonstrating ValGet’s long-term commitment to its project, its community, and its token’s value.

✅ Why it matters:

– Prevents price manipulation and large sell-offs

– Aligns with long-term development goals

– Builds trust with investors and partners

– Follows best practices in transparent tokenomics

🔗 Vesting Contract Link:

https://app.streamflow.finance/contract/solana/mainnet/GbDmrp5hSBup5u5deC7rXjyDEgvr3DBTEcLoLezdkcUX

ValGet ICO Launch Date Announced!

Mark your calendars! ValGet’s ICO is officially set to launch soon. This is your chance to be part of the next big crypto revolution.

ValGet is set to revolutionize investment by bridging cryptocurrencies and real-world assets. Our ICO presents a unique opportunity to acquire VALGET tokens at advantageous prices before their listing on major exchanges. Built on the Solana blockchain, we ensure speed, security, and transparency for all investors. Join us and be part of a new era of tokenized investment!

5 Reasons Why ValGet Is the Future of Crypto

ValGet offers transparency, security, and real-world integration, making it the ideal choice for crypto enthusiasts

ValGet introduces an innovative approach to cryptocurrencies by linking decentralized finance to real-world projects in key sectors like renewable energy, artificial intelligence, and real estate. Our project is based on:

➤ Transparency & Security through the Solana blockchain

➤ Real Investments ensuring tangible value for tokens

➤ Buyback and Burn Mechanism to stabilize and increase token value

➤ Democratized Investments accessible to both small and large investors

➤ Comprehensive Ecosystem with crowdfunding, a marketplace, and blockchain education

Community Insights on ValGet's Roadmap

ValGet’s roadmap prioritizes community engagement and real-world impact. Here’s what our community has to say.

Community engagement is at the core of ValGet. Our detailed roadmap includes key milestones such as the token launch, exchange integration, the development of crowdfunding and crowdsourcing platforms, and the first investments in high-impact projects. Each phase is designed to ensure stable and sustainable growth.

Community engagement is at the core of ValGet. Our detailed roadmap includes key milestones such as the token launch, exchange integration, the development of crowdfunding and crowdsourcing platforms, and the first investments in high-impact projects. Each phase is designed to ensure stable and sustainable growth.

➤ Next step: ICO Launch & DEX Listing

➤ Security & Audits: Audit report released ahead of schedule!

➤ Real-world projects: Selection of the first initiatives funded via ValGet

Why ValGet is More Than Just a Crypto Project

Secure & Transparent Investments

ValGet uses Solana’s blockchain to ensure secure, fast, and low-cost transactions. Every investment is fully audited, ensuring trust and transparency for all users.

ValGet places transparency and security at the core of its ecosystem by leveraging the Solana blockchain, known for its high-speed transactions and low fees. Every investment undergoes rigorous audits and verification to ensure absolute trust for investors. Through smart contracts and a transparent fund management system, ValGet eliminates risks of manipulation and ensures real-time tracking of assets. By joining ValGet, you are investing in a project where every transaction is traceable, and every funded project is subject to regular audits, ensuring maximum security for your capital.

Real Assets Supporting ValGet

Unlike purely speculative tokens, ValGet is backed by real-world investments in renewable energy, AI, and real estate, ensuring long-term value.

Unlike purely speculative cryptocurrencies, ValGet is backed by real and strategic investments. By bridging cryptocurrencies with key economic sectors such as renewable energy, artificial intelligence, and sustainable real estate, ValGet ensures its token has tangible value. Each funded project is carefully selected to provide stable returns and a positive impact on the real economy. This approach helps reduce market volatility and brings financial stability to investors by offering exposure to concrete and profitable assets.

Sustainable Tokenomics Strategy

With a buyback & burn mechanism, ValGet ensures a sustainable and increasing token value by reducing supply over time.

ValGet adopts a smart and sustainable economic strategy to ensure the gradual growth of its token while protecting investors. Through its buyback & burn mechanism, ValGet reinvests a portion of its revenue to buy back and burn its own tokens, thereby reducing the circulating supply. This approach gradually increases the token’s value, ensuring long-term scarcity. Additionally, revenues generated from funded projects are redistributed to investors as rewards, fostering a stable and attractive growth model over time.

High-Potential Projects for Strategic Investments

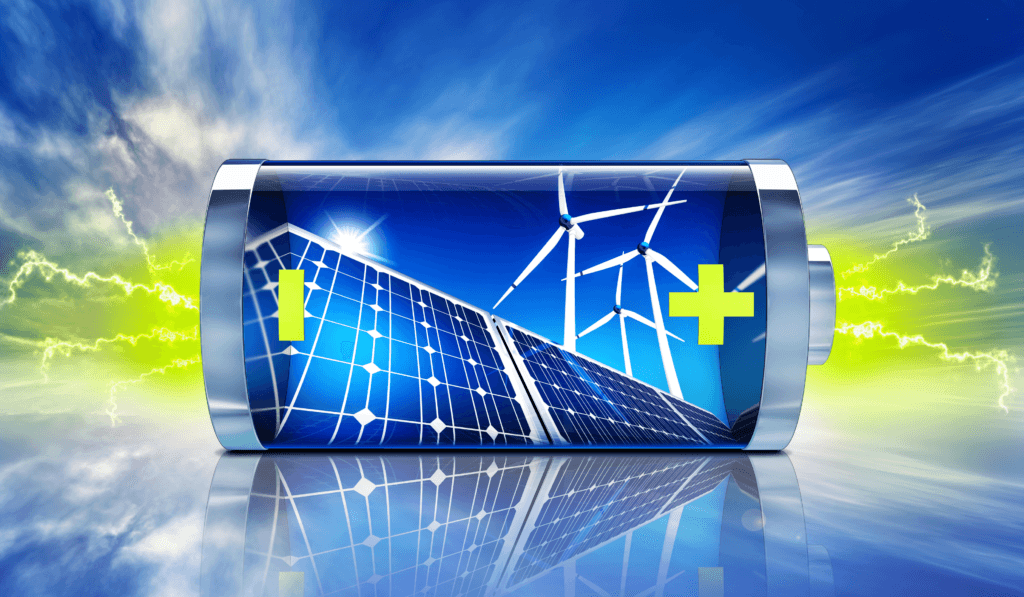

Renewable Energy Investments: Building a Sustainable Future

Learn why renewable energy sources like solar, wind, and hydrogen are essential pillars for a sustainable and profitable future.

Overview

The renewable energy sector, encompassing solar, wind, hydropower, and geothermal energy, has become one of the fastest-growing industries worldwide. Governments and corporations are increasingly shifting towards clean energy to combat climate change and meet their sustainability goals. Investments in renewable energy not only contribute to a cleaner planet but also offer stable, long-term returns.

Key Statistics

- The global renewable energy market is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2021 to 2028.

- By 2030, global renewable energy capacity could surpass 10,000 GW, driven by solar and wind installations.

Potential Returns

Investments in solar and wind farms have shown annual returns of between 6% to 15%. Large-scale renewable energy projects often sign long-term power purchase agreements (PPAs), guaranteeing steady cash flow for investors.

Example

Companies like NextEra Energy and Brookfield Renewable Partners have been pioneers in the sector, offering consistent returns to their investors. Brookfield Renewable has delivered annualized returns of 10% over the past decade.

Risk Factors

- High initial capital expenditure.

- Regulatory changes or reduced government subsidies.

- Variability in energy production due to weather conditions.

Sustainable Agriculture and Vertical Farming: Feeding the Future

Sustainable agriculture and vertical farming reinvent food production to meet global environmental and economic challenges.

With the world’s population projected to reach 9.7 billion by 2050, food demand is skyrocketing, requiring innovative agricultural solutions. ValGet invests in vertical farming and smart agricultural technologies, enabling 70% more efficient food production while reducing environmental impact.

With the world’s population projected to reach 9.7 billion by 2050, food demand is skyrocketing, requiring innovative agricultural solutions. ValGet invests in vertical farming and smart agricultural technologies, enabling 70% more efficient food production while reducing environmental impact.

🔹 Market Growth: Vertical farming is experiencing annual growth of 15% to 20%, driven by massive investments and digitalization in the sector.

🔹 Resource Optimization: These methods save 95% more water compared to traditional agriculture.

🔹 Food Security: With up to 390 times higher yields per hectare, vertical farming is a concrete solution to global food challenges.

By integrating these innovations into its ecosystem, ValGet promotes sustainable and profitable investments that are transforming the agricultural industry.

Cryptocurrencies and Blockchain: Innovating Financial Systems

Explore the potential of cryptocurrencies and blockchain technologies to revolutionize transactions and investments.

The financial sector is undergoing a major transformation, and blockchain is at the forefront of this revolution. ValGet leverages decentralized finance (DeFi) technologies to offer security, transparency, and accessibility to investors worldwide.

🔹 Crypto Market Growth: The cryptocurrency market capitalization exceeds $1.2 trillion and continues to rise.

🔹 Ultra-Fast Transactions: With Solana blockchain technology, ValGet ensures transactions in under 2 seconds with near-zero fees.

🔹 Global Impact: More than 1.7 billion people are still unbanked—blockchain technology allows them to participate in the financial system.

With ValGet, you invest in an innovative and evolving financial model, designed to address the challenges of tomorrow.

Artificial Intelligence (AI): The Future of Innovation

Artificial intelligence is transforming industries by automating processes, optimizing decision-making, and creating new opportunities for innovation. From healthcare to finance, AI is revolutionizing the way businesses operate, leading to increased efficiency and profitability.

Artificial Intelligence (AI): The Future of Innovation

Overview

Artificial intelligence is transforming industries by automating processes, optimizing decision-making, and creating new opportunities for innovation. From healthcare to finance, AI is revolutionizing the way businesses operate, leading to increased efficiency and profitability.

Key Statistics

- The global AI market is expected to grow at a CAGR of 42.2% from 2021 to 2027, reaching a market size of $733.7 billion by 2027.

- AI is projected to contribute over $15 trillion to the global economy by 2030.

Potential Returns

Investors in AI-based companies can expect substantial returns due to the sector’s high growth potential. Early-stage investments in AI startups can yield returns of 15% to 25% annually, depending on the market and the technology being developed.

Example

Investors in AI companies like Nvidia (focusing on AI hardware) and OpenAI (pioneers in machine learning) have seen tremendous growth. Nvidia’s stock has surged by 1200% over the last five years, driven by demand for AI chips.

Risk Factors

- Rapid technological advancements can render existing AI systems obsolete.

- High competition in the sector may limit profitability.

- Ethical and regulatory concerns surrounding AI implementation.

Real Estate: Stability and Growth in Commercial Property

Real estate, particularly commercial real estate (CRE), remains a cornerstone of long-term investment portfolios. The sector includes office buildings, retail spaces, industrial warehouses, and multi-family housing. CRE investments are known for their stability and potential for capital appreciation.

Real Estate: Stability and Growth in Commercial Property

Overview

Real estate, particularly commercial real estate (CRE), remains a cornerstone of long-term investment portfolios. The sector includes office buildings, retail spaces, industrial warehouses, and multi-family housing. CRE investments are known for their stability and potential for capital appreciation.

Key Statistics

- The global real estate market is expected to grow at a CAGR of 5.2% from 2021 to 2028, reaching a market size of $14.6 trillion.

- Commercial real estate in the U.S. offers average rental yields of 4% to 8% annually.

Potential Returns

Investors in commercial real estate can benefit from annual returns of 7% to 12%, depending on location and property type. REITs (Real Estate Investment Trusts) offer another avenue for investors to gain exposure to this market with relatively high dividends.

Example

Real estate firms like Blackstone have consistently delivered strong returns to their investors. Blackstone Real Estate Income Trust has an annualized return of 9%.

Risk Factors

- Market fluctuations and property devaluation.

- Vacancy rates and economic downturns affecting tenant occupancy.

- Maintenance and management costs.

Healthcare and Biotechnology: Investing in Life-Saving Innovation

Healthcare and biotechnology are among the most stable and essential sectors, offering a range of investment opportunities from pharmaceutical development to medical devices and biotechnology. The need for medical innovation is constant, driven by aging populations, chronic diseases, and emerging pandemics.

Overview

Healthcare and biotechnology are among the most stable and essential sectors, offering a range of investment opportunities from pharmaceutical development to medical devices and biotechnology. The need for medical innovation is constant, driven by aging populations, chronic diseases, and emerging pandemics.

Key Statistics

- The global biotechnology market is expected to grow from $752.88 billion in 2020 to $2.44 trillion by 2028, at a CAGR of 15.83%.

- The global healthcare market is projected to reach $10 trillion by 2025, making it one of the largest and most recession-proof industries.

Potential Returns

Investments in biotech companies, especially those developing new drugs or treatments, can yield returns between 12% to 25%. Additionally, the healthcare industry offers stable dividends from major pharmaceutical companies, providing consistent income for investors.

Example

Companies like Gilead Sciences and Moderna have delivered massive returns for their investors due to breakthroughs in biotechnology and vaccines. Moderna's stock has increased by more than 300% since 2020, driven by the success of its COVID-19 vaccine.

Risk Factors

- High research and development costs.

- Long regulatory approval processes.

- Competition and patent expiration.

FAQ’s

Frequently Asked Questions

What is ValGet, and how does it work?

ValGet is an innovative blockchain project that bridges cryptocurrencies with real-world investments. By leveraging the Solana blockchain, it allows investors to participate in projects from sectors such as renewable energy, AI, real estate, and sustainable agriculture. It ensures transparency and security through smart contracts and offers mechanisms like buy-back and burn to increase token value.

What makes ValGet different from other blockchain projects?

ValGet stands out by focusing on real-world impact rather than speculation. Unlike many cryptocurrency projects, it connects digital assets to tangible investments with long-term potential, ensuring sustainable growth and stability. The project also democratizes investment by allowing small investors to participate in high-potential projects.

How does the tokenomics of ValGet benefit investors?

ValGet’s tokenomics are designed to create long-term value for investors:

- 20% for pre-sale: Early investors get attractive bonuses.

- 10% for DEX liquidity: Ensures smooth trading.

- 20% for CEX platforms: Gradual release maintains market stability.

- 50% locked reserve: Released at 10% annually, preventing oversupply.

Additionally, the buy-back and burn mechanism reduces token supply, increasing token value over time.

What are ValGet's core investment sectors?

ValGet focuses on high-growth, sustainable sectors, including:

- Renewable energy (solar, wind, green hydrogen).

- Artificial intelligence (healthcare, finance, logistics).

- Real estate (commercial and residential).

- Sustainable agriculture and vertical farming.

- Medical technologies and biotechnology.

These sectors are chosen for their potential to deliver both societal impact and high returns.

How does ValGet ensure transparency and security for investors?

Transparency and security are core principles of ValGet:

- Smart Contracts: All transactions and investments are managed via audited smart contracts.

- Quarterly Audits: Regular third-party audits ensure accountability.

- Clear Roadmap: Investors can follow the project’s progress step-by-step.

- Revenue Allocation: 30% of project revenues are used for token buy-back and burn, and 40% are reinvested in new opportunities.